Stock savings

Popular Articles

Strategies to maximize your private pension provision through smart investments and use of Pillar 3a

Pension planning is not just about the question of whether to receive a pension or a capital sum, but about much, much, much more.

Saving means consciously not spending part of your income or existing money, but putting it aside for future needs or goals. But how should you save today? A savings account is hardly worthwhile any more due to the low interest rates in the Swiss franc. Equity investments, on the other hand, offer attractive long-term returns and should therefore be favored. Of course, the higher risks involved should not be neglected. The following article will show how these can be managed efficiently to enable attractive long-term equity savings.

Shares are avoided

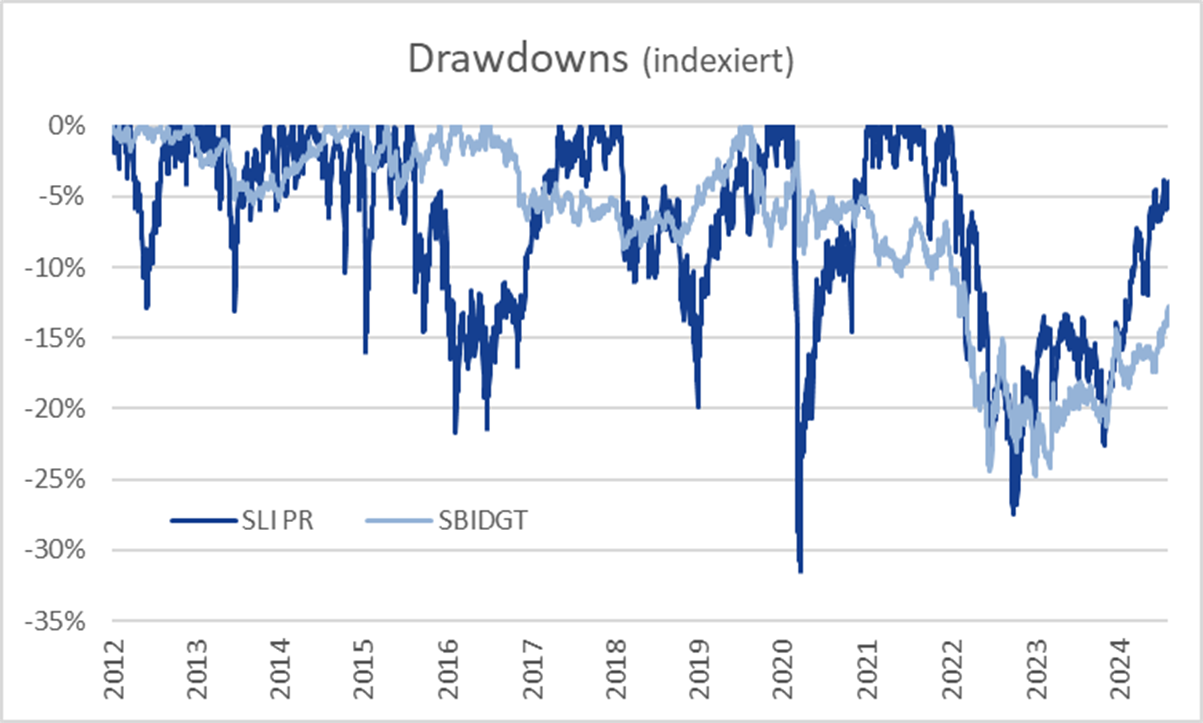

Investors are usually too cautious due to the risks involved and therefore limit their equity exposure. To diversify risk, they opt for a traditional allocation between the asset classes of liquidity, bonds and equities or invest directly in an investment strategy fund. From a one-sided risk perspective, this can make perfect sense (max. drawdowns since January 3, 2012: equities / PLI PR -31% [January 2020, corona], bonds / SBIDGT -25% [December 2022, rising interest rates]). But what does this look like in a two-dimensional view from an earnings perspective?

Comparison of the drawdowns of equities (SLI PR) and bonds (SBIDGT), own chart

Equities as a pillar of long-term returns

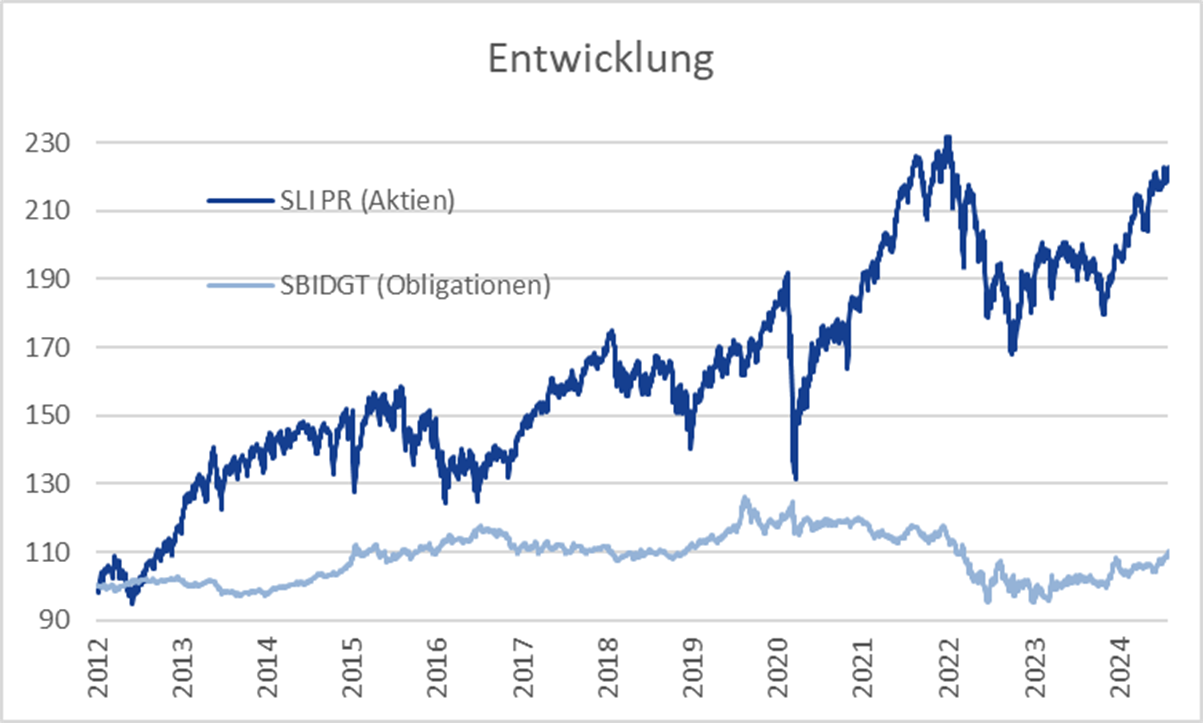

Equities are the most profitable liquid asset class and are indispensable for long-term wealth accumulation. However, since, as described above, equity returns fluctuate more than bond returns, the equity allocation in many portfolios is often kept too low. This not only limits the risks, but also the opportunities. This is because when equity markets rise (and they have been doing so for over 10 years), valuable returns are lost (performance since 3.1.2012: equities / PLI PR +123%, bonds / SBIDGT +10%).

Performance of equities and bonds, own chart

Time for a new approach

It is therefore time to 'rethink' saving and consistently use equities for this purpose. Why limit the proportion of equities in the strategy and forgo returns just because of the interim negative fluctuations when equities offer the best returns? There is no way around equities for long-term success. If you can tolerate the fluctuations described above, there are already very simple solutions available today in the form of passive ETFs on various share indices to achieve your savings goals.

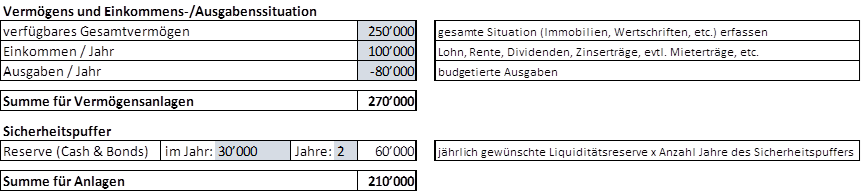

For all those who cannot sleep peacefully because of these fluctuations, there is a simple pragmatic approach. Instead of a complicated definition of the risk profile and the corresponding choice of investment strategy, the first step is to determine the investment amount.

Simple determination of the investment amount, own illustration

Manage risks, not avoid them

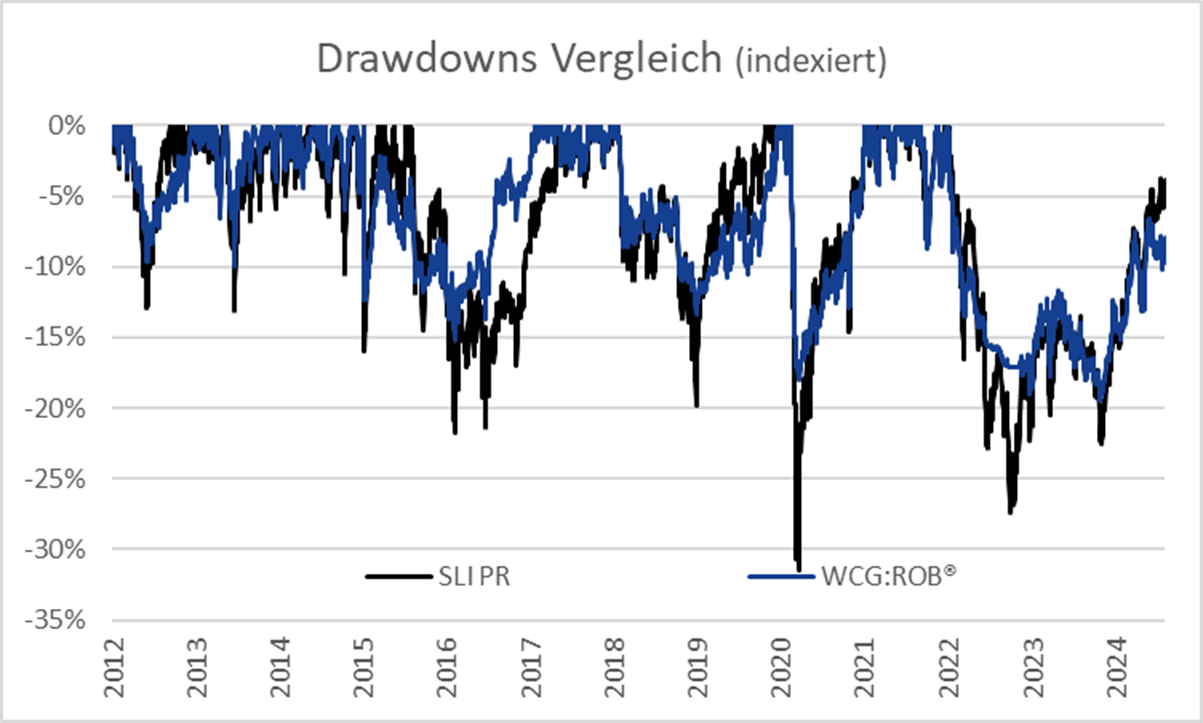

In the second step, this amount can be fully invested. Consistent, rule-based management of an equity universe (in the following example, the Swiss Leader Index / SLI) is key to benefiting from higher long-term equity market returns while limiting the risk of fluctuation. Such a risk-focused approach reduces negative fluctuations (drawdown) and thus improves the risk/return ratio (Sharpe ratio).

Comparison of equity drawdowns (SLI PR) and WCG:ROB® (risk-focused management approach for equities), own chart

| Key figures | WCG:ROB® | SLI PR |

| Average return | 6.5% | 6.6% |

| Volatility | 10.6% | 15.7% |

| Sharpe Ratio | 0.64 | 0.49 |

| Drawdown | -19% | -31% |

Key figures 3.1.2012 - 30.7.2024 of WCG:ROB® vs. SLI PR, own presentation

Conclusion

If you want to sleep more soundly, invest in equities with a focus on risk. WCG:ROB®, the revolutionary way to save in shares! Interested? Contact us for a non-binding initial consultation.

The contents of this article were written by registered financial advisors. FinFinder.ch assumes no responsibility for the content or editorial content of the information provided.