Maximum return in Pillar 3a: How to make retirement planning a success

Popular Articles

The article explains the potential and risks of crypto assets in financial planning and emphasizes the need for sound advice in order to make the most of the opportunities offered by this emerging asset class.

The savings account is no longer worthwhile due to the low interest rates in Swiss francs.

Pensions from the pension fund are falling and the AHV is also facing demographic challenges. Private pension provision is therefore becoming increasingly important. But how can you make better financial provision for old age?

Pension provision in Switzerland: a growing concern

Pension provision has been one of the Swiss population's biggest concerns for years. The approval of the 13th AHV pension by voters in March 2024 will hardly change this. Demographic change remains a key issue.

Fewer working people per pensioner

For almost 40 years, the Swiss pension system has been based on the three pillars of AHV, occupational pension provision (pension funds) and private pension provision (pillars 3a and 3b). Since the introduction of occupational pension provision and pillar 3a in 1985, life expectancy has increased considerably: Men now live on average nine years longer, women around six years longer. At the same time, the birth rate has fallen from 1.9 to 1.39 children per woman. This means that the number of people in employment is continuing to fall, while the number of pensioners is rising. Over the past 20 years, expected pensions have fallen significantly. The impending retirement of the baby boomers of the 1950s and 1960s is particularly challenging. Private pension provision is therefore becoming increasingly important.

More and more Swiss are making provisions for old age with pillar 3a

Pillar 3a as an instrument for private pension provision is extremely popular in Switzerland. A representative survey conducted by Comparis in 2022 shows that almost 70% of Swiss people make use of tax-privileged private pension provision. Employed persons can pay a maximum of CHF 7056 per year into pillar 3a on a tax-privileged basis, while self-employed persons can pay up to CHF 35,750 or 20% of their earned income.

3a accounts as a loss-making business

The market for third-pillar pension solutions is huge. Around 140 billion francs are slumbering here - mostly still in 3a accounts that hardly yield any returns. This is shown by figures from the Federal Social Insurance Office (FSIO) from 2022. 3a accounts used to be an alternative to securities solutions due to attractive interest rates. However, interest rates have fallen sharply in recent years and inflation is currently outstripping interest rates, resulting in a loss-making business.

Traditional insurers and established banks dominate the market. Just under two thirds, or around CHF 90 billion, of 3a assets are held by banks. Only around a third of these assets are invested in securities or investment funds. The FSIO's pay-in and pay-out data also shows that women are on average more cautious in their investment decisions and therefore prefer less risky forms of investment, which can also lead to lower investments in securities.

Insurance policies consisting of a savings and an insurance component are also popular. A survey by VZ VermögensZentrum found that 43% of men and 22% of women use this form.

Optimization of private pension provision

The studies mentioned above show that the opportunities offered by private pension provision are often only partially utilized. One way to optimize this is to open several 3a accounts or securities accounts in order to have the money paid out in stages and save on taxes.

Investing correctly is crucial

Due to the long-term nature of pillar 3a assets, they are ideally suited to being invested (correctly). However, the selection and expected return of the individual solutions are crucial. Securities solutions are still not very widespread. This comes as a surprise because the investment horizon for securities investments is still sufficiently long even beyond the age of 50. Anyone who invests in equities for their private pension generally relies on a moderate quota. Few take advantage of the opportunity to invest 75 or even 100 percent of 3a assets in equities and thus benefit from higher long-term returns. Many banks and insurance companies offer pension funds that have a mixed investment structure and focus on fixed-interest securities. Due to the low interest rates, this often results in a negative result for the investor after costs.

According to a study by Banque Pictet, anyone who had invested their pension assets in the Swiss equity market would have been compensated with an annual nominal return of 7.7% over the past almost 100 years; after deducting inflation, this was still 5.6%. Incidentally, with an investment horizon of 13 years and more, no loss was ever made on the Swiss equity market.

Do not underestimate the compound interest effect

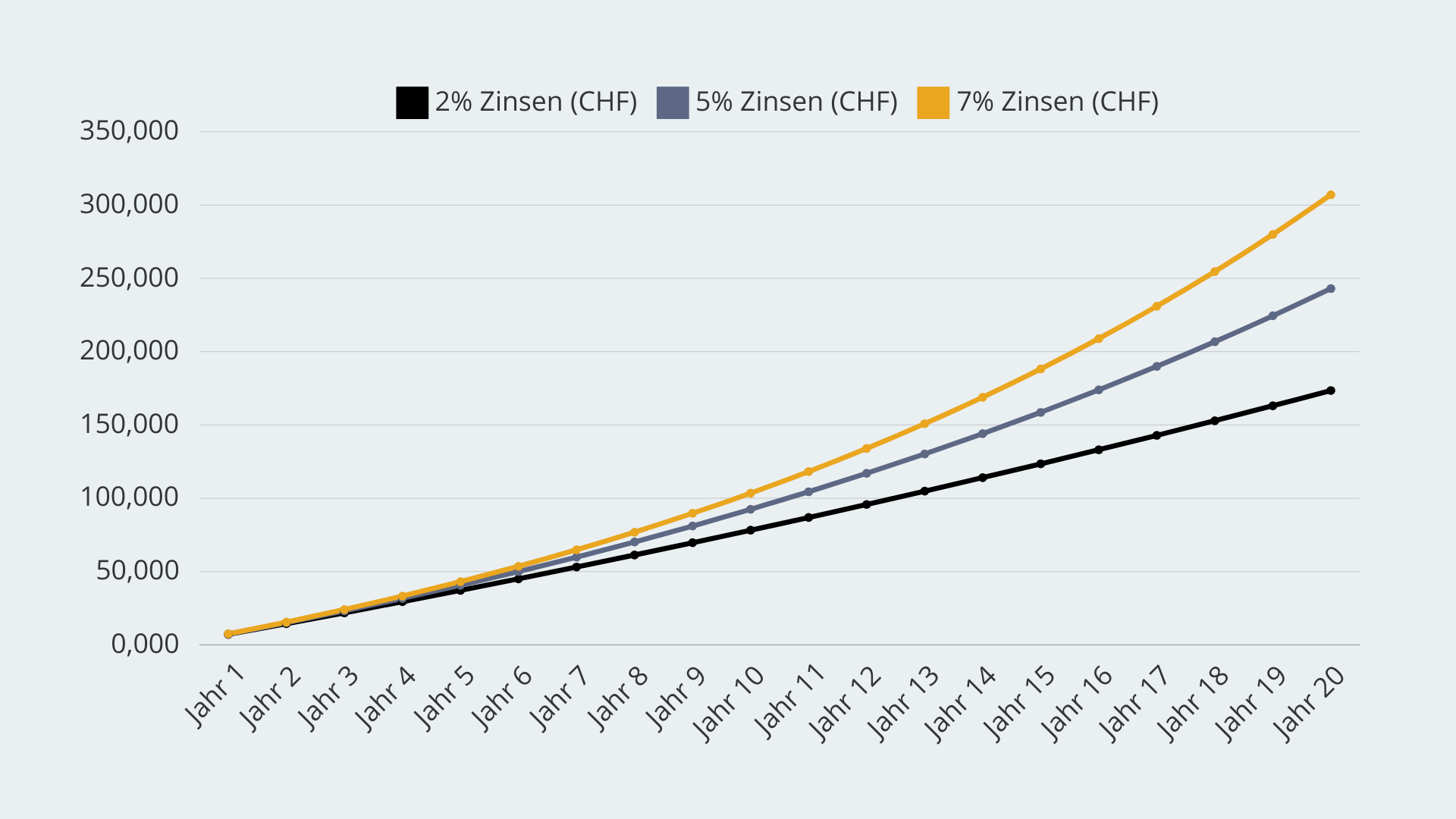

Experience shows that many investors underestimate the magic of compound interest. Even small differences in returns and costs can make a huge difference in the end. As an example, we pay CHF 7,000 per year (maximum amount in 2024 is CHF 7,056) into pillar 3a for 20 years. With an interest rate of 2%, we will receive around CHF 173,000 after 20 years. At 5%, it is around CHF 243,000, and with a return of 7%, we will be around CHF 307,000 richer after 20 years.

Conclusion

Private pension provision is becoming increasingly important, but studies and our own experience show that many people are not yet taking full advantage of the opportunities offered by the third pillar. It is particularly important for younger generations to learn from these findings and optimize their private pension provision. It is unlikely that the financial situation of the AHV and pension funds will improve so much by the time they retire that these pensions will be sufficient to secure their standard of living in old age. It is therefore all the more important to take measures in good time and strengthen private pension provision. It is advisable to give careful thought to the choice of investment solution, especially for pillar 3a. The compound interest effect has an enormous influence on the final amount that we can expect when we retire over the long investment period. The right decision can therefore quickly lead to differences of several tens of thousands of francs.

The contents of this article were written by registered financial advisors. FinFinder.ch assumes no responsibility for the content or editorial content of the information provided.